Makaleler

54

Tümü (54)

SCI-E, SSCI, AHCI (35)

SCI-E, SSCI, AHCI, ESCI (43)

ESCI (9)

Scopus (43)

TRDizin (9)

Diğer Yayınlar (5)

10. Assessment of dependent risk using extreme value theory in a time-varying framework

HACETTEPE JOURNAL OF MATHEMATICS AND STATISTICS

, cilt.52, sa.1, ss.248-267, 2023 (SCI-Expanded, Scopus)

14. Risk Distribution Among Uncorrelated Risk Factors: Diversified Risk Parity

Hacettepe Üniversitesi İktisadi ve İdari Bilimler Fakültesi Dergisi

, cilt.40, sa.2, ss.419-439, 2022 (TRDizin)

16. Optimal Premium allocation understop-loss insurance using exposure curves

HACETTEPE JOURNAL OF MATHEMATICS AND STATISTICS

, cilt.1, sa.1, ss.1-20, 2022 (SCI-Expanded, Scopus, TRDizin)

17. Optimal premium allocation under stop-loss insurance using exposure curves

HACETTEPE JOURNAL OF MATHEMATICS AND STATISTICS

, cilt.51, sa.1, ss.288-307, 2022 (SCI-Expanded, Scopus, TRDizin)

24. FORECASTING MORTALITY RATES WITH A GENERAL STOCHASTIC MORTALITY TREND MODEL

COMMUNICATIONS FACULTY OF SCIENCES UNIVERSITY OF ANKARA-SERIES A1 MATHEMATICS AND STATISTICS

, cilt.69, sa.1, ss.910-928, 2020 (ESCI, TRDizin)

26. The estimation of adopted mortality and morbidity rates using model and the phase type law: the Turkish case

Communications in Statistics: Simulation and Computation

, cilt.48, sa.9, ss.2552-2565, 2019 (SCI-Expanded, Scopus)

27. Drought analysis using copula approach: a case study for Turkey

Communications in Statistics Case Studies Data Analysis and Applications

, cilt.5, sa.3, ss.243-260, 2019 (Scopus)

28. Quantitative hazard assessment for Zonguldak Coal Basin underground mines

INTERNATIONAL JOURNAL OF MINING SCIENCE AND TECHNOLOGY

, cilt.29, sa.3, ss.453-467, 2019 (SCI-Expanded, ESCI, Scopus)

29. ASSESSMENT OF SUPPLIER RISK FOR COPPER PROCUREMENT

COMMUNICATIONS FACULTY OF SCIENCES UNIVERSITY OF ANKARA-SERIES A1 MATHEMATICS AND STATISTICS

, cilt.68, sa.1, ss.1045-1060, 2019 (ESCI, TRDizin)

43. Estimation of earthquake insurance Premium rates Turkish catastrophe insurance pool case

AÜÜF Communications: Series A1: Mathematics and Statistics

, cilt.65, ss.161-173, 2016 (Hakemli Dergi)

45. Analysis of portfolio diversification between REIT assets

JOURNAL OF COMPUTATIONAL AND APPLIED MATHEMATICS

, cilt.259, ss.425-433, 2014 (SCI-Expanded, Scopus)

48. Length biased Inverse Gaussian Hazard Rate Estimation A Predictive Density Approach

Advances and Applications in Statistics

, cilt.6, ss.217-233, 2006 (ESCI)

50. Compulsory Earthquake Insurance Scheme for Residences In Turkey And Its Implications

Journal of International Insurance

, cilt.1, ss.447-457, 2001 (Hakemli Dergi)

51. Nonnormal regression. II. Symmetric distributions

COMMUNICATIONS IN STATISTICS-THEORY AND METHODS

, cilt.30, sa.6, ss.1021-1045, 2001 (SCI-Expanded, Scopus)

54. The Turkish Insurance Market Land of Opportunity

Journal of International Insurance

, cilt.1, ss.77-90, 1999 (Hakemli Dergi)

Hakemli Bilimsel Toplantılarda Yayımlanmış Bildiriler

74

17. Ischemic heart disease mortality rate estimation using hidden markov regression model

23rd International Congress on Insurance: Mathematics and Economics (IME 2019), Munich, Almanya, 10 - 12 Temmuz 2019, (Özet Bildiri)

18. Risk Classification with Artificial Neural Networks Models in Motor Third Party Liability

International Conference on Data Science, Machine Learning and Statistics - 2019(DMS-2019), Van, Türkiye, 26 - 29 Haziran 2019, (Özet Bildiri)

22. Analyzing Housing Market Dynamics using Linear and non-Parametric Models

11. International Statistics Days Conference, Muğla, Türkiye, 3 - 07 Ekim 2018, (Özet Bildiri)

23. Extreme Value Theory on Valuation of Actuarial Risk

11. International Statistics Days Conference, BODRUM, Türkiye, 3 - 07 Ekim 2018, (Özet Bildiri)

26. Multivariate Extreme Value Theory on the Valuation of Tail Behavior in Actuarial Science

4th European Actuarial Journal Conference, Leuven, Belçika, 9 - 11 Eylül 2018, (Özet Bildiri)

27. Optimal Stop-Loss Reinsurance: A Dependence Analysis of Aggregate Claims under Certain Distributions

4th European Actuarial Journal Conference, Leuven, Belçika, 9 - 11 Eylül 2018, ss.61, (Özet Bildiri)

30. Drought Forecasting with Time Series and Machine Learning Approaches

10.International Statistics Congress (ISC2017), Ankara, Türkiye, 6 - 08 Aralık 2017, ss.200, (Özet Bildiri)

31. Dependence Analysis with Normally Distributed Aggregate Claims in Stop Loss Insurance

10th Internatioanal Statistics Congress (ISC2017) Ankara, Ankara, Türkiye, 6 - 08 Aralık 2017, (Özet Bildiri)

32. Risk Measurement Using Extreme Value Theory: The Case of BIST100 Index

10th International Statistics Congress, Ankara, Türkiye, 6 - 08 Aralık 2017, (Özet Bildiri)

33. Stochastic risk assessment of an insurance portfolio underrenewal process with VaR and CVaR as initial capital

2nd International Conference on Computational Finance, 4 - 08 Eylül 2017, (Özet Bildiri)

35. Multivariate Analysis of Drought Characteristics using Vine Copula Approach.

Copulas and Their Applications to Commemorate the 75th Birthday of Professor Roger B. Nelsen, Almeria, İspanya, 3 - 05 Temmuz 2017, (Özet Bildiri)

36. Determination of Sensitivities for Mortgage Default and Prepayment Options

8th General AMaMeF Conference, Amsterdam, Hollanda, 19 - 23 Haziran 2017, ss.58, (Özet Bildiri)

37. The Effect of Macro-Economic Factors on Housing Markets: US Case

IRSYSC 2017 – 3RD INTERNATIONAL RESEARCHERS, STATISTICIANS AND YOUNG STATISTICIANS CONGRESS, Konya, Türkiye, 24 - 26 Mayıs 2017, ss.228, (Özet Bildiri)

38. The Influence of Longevity Risk on Pension Funds: Turkish Case

3RD INTERNATIONAL RESEARCHERS, STATISTICIANS AND YOUNG STATISTICIANS CONGRESS, Konya, Türkiye, 24 - 26 Mayıs 2017, (Özet Bildiri)

39. Mixture of Vine Copulas for Complex and Hidden Dependence

Recent Developments in Dependence Modeling and Applications in Finance and Insurance, Island of Aegina, Yunanistan, 22 - 23 Mayıs 2017, (Özet Bildiri)

40. An Alternative Stochastic Mortality Trend Model

PARTY 2017, 8 - 13 Ocak 2017, (Özet Bildiri)

46. Stochastic Surplus Process and Constrained Portfolio Optimisation with VaR and CVaR

EAJ 2016 & IA Summer School, 5 - 08 Temmuz 2016, (Özet Bildiri)

47. Assessment of Multivariate Drought Index via Vine Copula

Dependence Modeling inFinance, Insurance and Environmental Science, Munich, Almanya, 17 - 19 Mayıs 2016, (Özet Bildiri)

50. Energy ConsumptionAnd Economic Growthİn Turkey Is CopulaFramework Possible

İSTKON9, 28 Ekim - 01 Kasım 2015, (Özet Bildiri)

53. Bulanık Kümeleme ile Deprem Sigortası Risk Değerlendirmesi

9. Uluslararası İstatistik Kongresi, 28 - 30 Ekim 2015, ss.238-239, (Özet Bildiri)

54. Stokastik Faiz Oranı ve Mortalite Etkisi Altında Hayat Sigortası Prim Hesaplaması

9. Uluslararası İstatistik Kongresi, Antalya, Türkiye, 28 Ekim - 01 Kasım 2015, (Özet Bildiri)

57. Comparative Study on REIT Returns In Borsa Istanbul By Using Single Index And Fama French Methods

European Real Estate Society 22nd Annual Conferance, İstanbul, Türkiye, 24 - 27 Haziran 2015, (Özet Bildiri)

64. A Comparative Reliability Analysis for Draglines in Turkey

21st International Symposium on Mine Planning and Equipment Selection, YENİ DELHİ, Hindistan, 28 - 30 Kasım 2012, cilt.1, ss.166-172, (Tam Metin Bildiri)

65. Assessment of Survival Models in Constructing Morbidity Tables

Symposium on Biomathematics and Ecology: Education and Research, 15 - 16 Ekim 2010, (Özet Bildiri)

66. Risk Assessment of a micro insurance portfolio

24th Mini Euro Conference EurOPT, 1 - 03 Ocak 2010, (Özet Bildiri)

68. Split Plot Designs under Nonnormality

53rd Session of ISI, Bulletin of International Statistical Institute, Seul, Güney Kore, 14 - 16 Ocak 2001, (Tam Metin Bildiri)

71. Statistical Analysis of Underground Accidents in Tunçbilek Türkiye Based on Risk Management Techniques

Sixth International Conference on Environmental Issues and Management of Waste Energy and Mineral Production (SWEMP),, 2 - 04 Ocak 2000, (Tam Metin Bildiri)

73. Reliability Lifeline Networks with Multiple Sources Under Seismic hazard

Proceedings, 50th Session of ISI, Book 2, 1076-1077, Pekin, Çin, 4 - 06 Eylül 1995, (Özet Bildiri)

Kitaplar

8

7. A Bayesian Pricing Model for CAT Bonds

Springer Proceedings in Mathematics Statistics : Modeling, Dynamics, Optimization and Bioeconomics I, Alberto Pinto and David Zilberman, Editör, Springer, London/Berlin , Amsterdam, ss.1-45, 2014

Metrikler

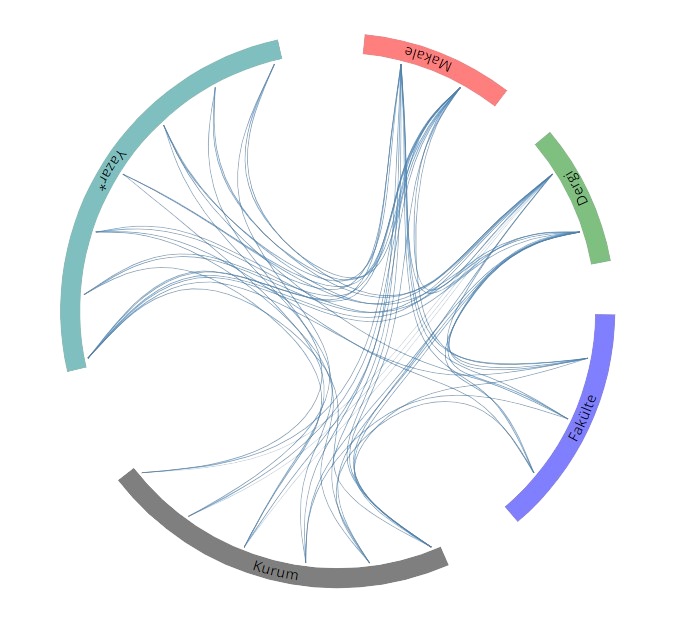

Yayın Ağı

Yayın Ağı