Makaleler

6

Tümü (6)

SCI-E, SSCI, AHCI (4)

SCI-E, SSCI, AHCI, ESCI (5)

ESCI (1)

Scopus (4)

TRDizin (2)

4. Assessment of dependent risk using extreme value theory in a time-varying framework

HACETTEPE JOURNAL OF MATHEMATICS AND STATISTICS

, cilt.52, sa.1, ss.248-267, 2023 (SCI-Expanded, Scopus)

6. Effect of Turkish mortality developments on the expected lifetime and annuity using entropy measure

İstatistikçiler Dergisi: İstatistik ve Aktüerya

, cilt.13, sa.1, ss.30-47, 2020 (TRDizin)

Hakemli Bilimsel Toplantılarda Yayımlanmış Bildiriler

16

9. Extreme Value Theory on Valuation of Actuarial Risk

11. International Statistics Days Conference, BODRUM, Türkiye, 3 - 07 Ekim 2018, (Özet Bildiri)

10. Multivariate Extreme Value Theory on the Valuation of Tail Behavior in Actuarial Science

4th European Actuarial Journal Conference, Leuven, Belçika, 9 - 11 Eylül 2018, (Özet Bildiri)

11. Risk Measurement Using Extreme Value Theory: The Case of BIST100 Index

10th International Statistics Congress, Ankara, Türkiye, 6 - 08 Aralık 2017, (Özet Bildiri)

12. The Influence of Longevity Risk on Pension Funds: Turkish Case

3RD INTERNATIONAL RESEARCHERS, STATISTICIANS AND YOUNG STATISTICIANS CONGRESS, Konya, Türkiye, 24 - 26 Mayıs 2017, (Özet Bildiri)

15. Stokastik Faiz Oranı ve Mortalite Etkisi Altında Hayat Sigortası Prim Hesaplaması

9. Uluslararası İstatistik Kongresi, Antalya, Türkiye, 28 Ekim - 01 Kasım 2015, (Özet Bildiri)

16. The effect of Turkish mortality improvements on the cost of annuities using entropy measure

EURO Working Group Commodities and Financial Modelling, Ankara, Türkiye, 12 - 14 Mayıs 2015, (Özet Bildiri)

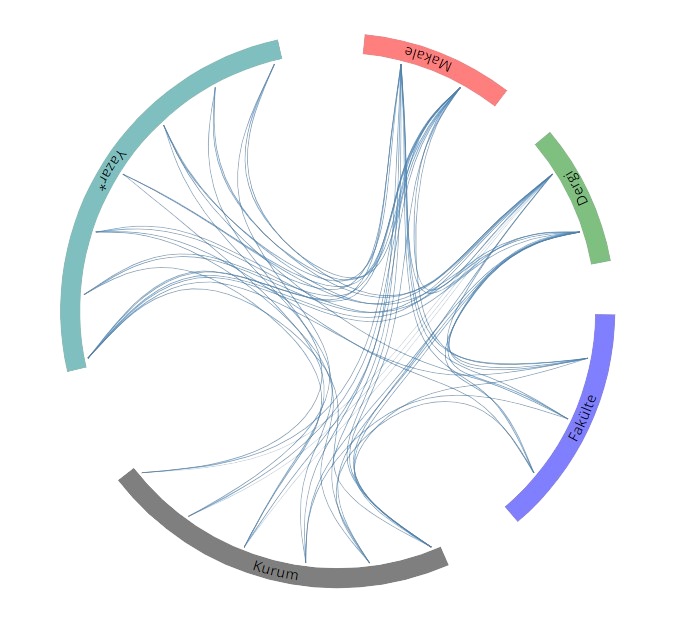

Yayın Ağı

Yayın Ağı